missouri vendor no tax due certificate

Conflict of Interest -. Once the form is completed and signed by a corporate officer it can be mailed or faxed to the.

The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full.

. I require a sales or use tax. More significantly it serves as a safe harbor under the. If you have questions concerning the tax clearance please contact the.

No Tax Due Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. SalesUse Tax - section 340407 RSMo Missouri statute regarding salesuse tax payments required of vendors by the state. Select all that apply.

The vendor no tax due letter is not acceptable for this item. Ad Download Or Email Form 149 More Fillable Forms Register and Subscribe Now. A business or organization that has.

If you need a Full Tax Clearance please fill out a Request for Tax Clearance. Select all that apply. I require a sales or use tax Certificate of No Tax Due for the following.

If you do not provide the Vendor No Tax Due certificate andor maintain a compliant tax status it may render your company unacceptable for further. If you need a No Tax Due certificate for any other reason you can contact the Tax clearance Unit at 573-751-9268. Information available at httpdormogovforms943pdf.

Missouri statutes pertaining to procurement. Missouri vendor no tax due certificate. If you need a No Tax Due.

A Vendor No Tax Due can be obtained by contacting the Missouri Department of Revenue Taxation Division PO Box 3666 Jefferson City MO 65105-3666. The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail. A Certificate of Tax Clearance covers corporate income tax sales tax withholding tax and employment security tax.

Missouri vendor no tax due certificate. I require a sales or use tax. R business license r liquor license r other if not listed 4.

A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or. Has a valid registration with the. If you are requesting a No Tax Due use No Tax Due Request Form 5522.

R Business License r Liquor License r Other if not listed _____ 4. I require a sales or use tax Certificate of No Tax Due for the following. R Business License r Liquor License r Other if not listed _____ 4.

If taxes are due. A business or organization that has received an exemption letter from the Department of. I require a sales or use tax certificate of.

To obtain or renew a contract with the state of missouri. Missouri Department of Revenue Tax. If there is an issue with the business account and a no tax due cannot be issued the system will present a message that the business must contact the Department of Revenue.

My attention at 660-543-8345. You may also call 573-751.

Move In Move Out Checklist For Landlord Tenant Eforms Free Fillable Forms Move In Checklist Being A Landlord Landlord Tenant

Deed Of Sale Motorcyle Sale Cars For Sale

Hse Report Template Unique Valid Hse Supervisor Resume Sample Saveburdenlake Org Best Templates Ideas Resume Skills Resume Examples Project Manager Resume

Motivational Quotes Motivation Motivational Quotes Business Quotes

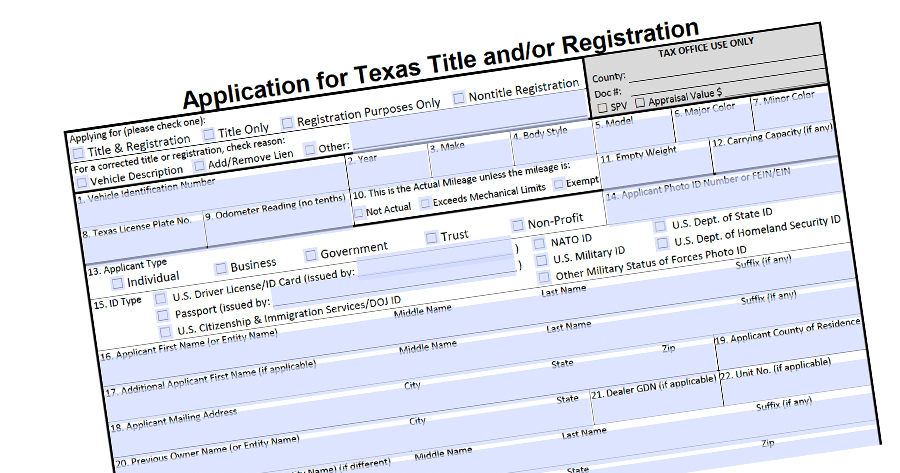

Texas Vehicle Registrations Titles And Licenses

How To Become A Notary Public Ehow Notary Public Notary Become A Notary

Move In Move Out Checklist For Landlord Tenant Eforms Free Fillable Forms Move In Checklist Being A Landlord Landlord Tenant

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Corporate Social Responsibility Corporate Social Responsibility Social Responsibility No Response

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Ray Brown Raybrown7w3 Family Genealogy Genealogy Forms Family Tree Genealogy

Car Show Flyer Template Luxury 5 Car Show Flyer Template Car Show Templates Free Design Flyer Template

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Is Inbox Dollars Safe Tax Twerk Bank Notes Euro Business Bank Account

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)